We Partner With Million Dollar Brands To Help Them Grow, Scale, and Exit Their Business

Dr. Kumar Ramlall and Amit Ramlall

Co-Founders of Chintan Project

HERE'S JUST A FEW OF OUR TEAM'S PORTFOLIO COMPANIES

HERE'S JUST A FEW OF OUR TEAM'S PORTFOLIO COMPANIES

A PROVEN SYSTEM FOR GROWTH

*$10M+ | **$100M+ | ***$1B+

**Medical Billing

*eLearning *

**Commercial Real Estate

***Residential Real Estate

*Trade Shows/Events

*Sporting Goods

**Direct Response

**Restaurants

**CPG

*Corporate Training

*Document Preparation

*Medical Equipment

**Machine Manufacturing

*Sporting Goods

*Pet Products

*Mastermind Groups

*Supplements

*Real Estate Training

*Online Casinos

*eCommerce

*Telecom Infrastructure

*Beauty + Cosmetics

*Business Services

**Software As A Service

**Medical Billing

*eLearning *

**Commercial Real Estate

***Residential Real Estate

*Trade Shows/Events

*Sporting Goods

**Direct Response

**Restaurants

**CPG

*Corporate Training

*Document Preparation

*Medical Equipment

**Machine Manufacturing

*Sporting Goods

*Pet Products

*Mastermind Groups

*Supplements

*Real Estate Training

*Online Casinos

*eCommerce

*Telecom Infrastructure

*Beauty + Cosmetics

*Business Services

**Software As A Service

OUR ADVISORY BOARD

Roland Frasier

Advisor

1,000+ acquisitions + exits

6 INC Fastest Growing Cos

$4B+ Portfolio Sales

7 $1 00M Companies Built

Grant Teeple

Advisor

M&A Attorney

Buy + Sell Side Acquisitions

$1 B+ In Transactions

Founder of Teeple Hall, LLP

Ryan Deiss

Advisor

Marketing + Growth

Founder DigitalMarketer

17 acquisitions + exits

Seven 8-Figure Businesses

Richard Lindner

Advisor

Co-Founder at Scalable.co

perations + Optimization

Leadership, Management

5 Acquisitions + Exits

DeAnna Rogers

Advisor

Founder of Evolve Events

Inside Sales, Monetization

Recruiting + Logistics

Live+ Virtual Events

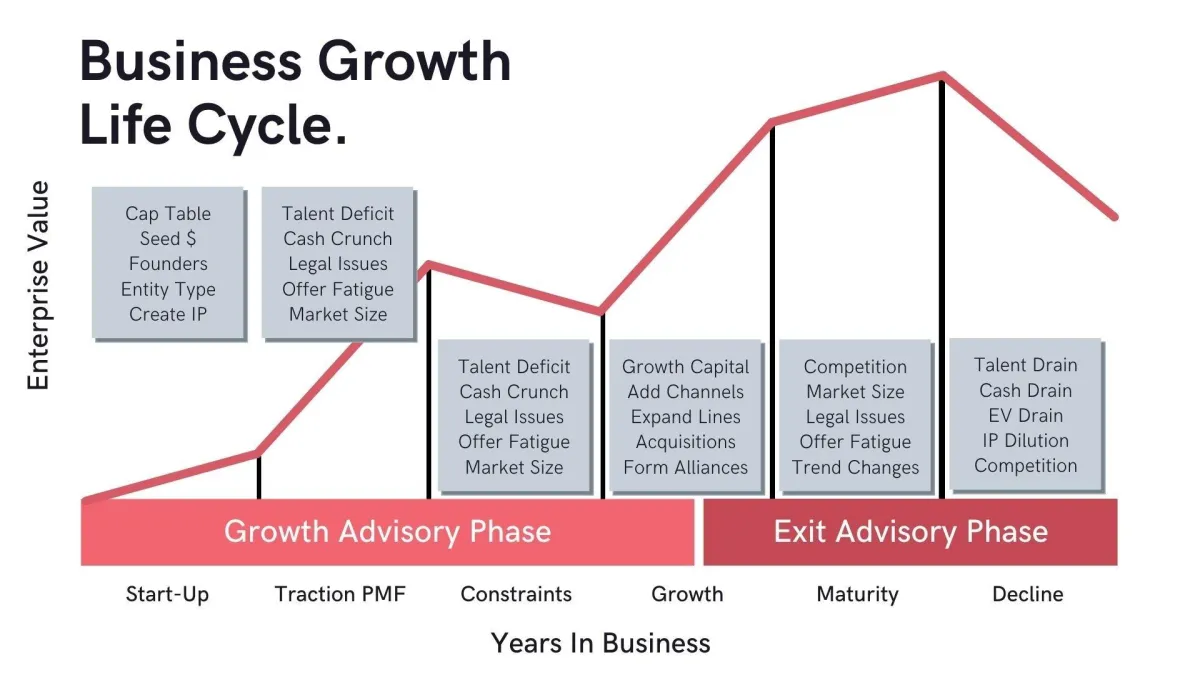

BUSINESS GROWTH LIFE CYCLE

Entrepreneurship is a journey characterized by various experiences, including challenges and successes. One noteworthy milestone is advancing your business. The prospect of exiting might seem overwhelming; however, it's crucial to explore the diverse exit options and identify the one that best aligns with your goals.

The business life cycle represents the gradual development of a business through distinct phases over time, typically categorized into six stages: launch, traction, constraints, growth maturity, and decline.

FOCUS #1: INCREASING SALES

LEVERAGED SALES

Case Study: Transforming a $360k E-commerce Business into a $31M Powerhouse

More Sales + More Profit = Scalability

Background:

Our client, a thriving $360,000-per-year e-commerce business, approached us with a vision to scale their operations. Their goal was ambitious: an 86-fold increase in annual revenue. With a solid foundation in digital information sales, the challenge was to diversify their product offerings, implement strategic management practices, and position the company for a lucrative exit.

Challenges:

Limited Revenue Stream: The business relied heavily on digital info sales, exposing them to market fluctuations.

Operational Bottlenecks:

Inefficiencies in day-to-day operations were hindering scalability.

Leadership Vacuum:

The absence of professional management hindered strategic decision-making.

Our Approach:

Diversification Strategy: Identified and introduced complementary products to expand revenue streams. Conducted market research to align new products with customer demands.

Operational Optimization: Streamlined internal processes, reducing bottlenecks and enhancing efficiency. Implemented advanced technologies to automate repetitive tasks and boost productivity.

Strategic Leadership: Recruited experienced professionals to lead key departments. Established a leadership team with a proven track record in scaling businesses.

Results:

Annual revenue catapulted from $360,000 to an astounding $31 million.

Diversification efforts led to a resilient business model, reducing dependency on a single revenue

stream.

Operational optimizations resulted in a more agile and scalable business structure.

The introduction of professional management enhanced strategic decision-making.

Exit Strategy:

This partnership resulted in a profitable exit, being acquired by a billion-dollar company. The acquisition marked a milestone in the client's entrepreneurial journey, providing a substantial return on investment.

Summary:

Whether you're looking to scale, diversify, or position your business for a lucrative exit, our tailored solutions are designed to turn your aspirations into reality. Partner with us, and let's embark on a journey of unparalleled growth and success.

FOCUS #2: INCREASING PROFIT

BANKABLE PROFIT

Case Study: Profitably Scaling Professional Services

More Profit + More Value = Optionality

Challenge:

Our client, a rapidly growing professional services company, approached us with the objective of reshaping their business model for optimal performance. The challenges were clear - enhancing profitability, reducing staffing needs, and lowering operating costs.

Our Approach:

Strategic Redesign: Conducted a comprehensive analysis of the existing business model to identify areas for improvement and formulated a strategic redesign plan.

Profitability Enhancement: Implemented revenue optimization strategies to maximize income streams with innovative pricing models to capture additional value from existing services.

Efficiency Measures: Streamlined operational processes to minimize redundancy and enhance productivity. Leveraged technology solutions to automate routine tasks, reducing the need for excessive staffing.

Cost Reduction Initiatives: Conducted a thorough cost audit to identify and eliminate unnecessary expenses. Negotiated favorable contracts with suppliers to achieve cost savings.

Results:

Profit Surge: Profits soared by an impressive 300%, reflecting the success of our strategic interventions.

Staffing Efficiency: Through operational streamlining and automation, staffing needs were significantly reduced, ensuring a lean and highly efficient workforce.

Operational Cost Slashed: Operating costs were slashed by 67%, making the business more resilient and competitive.

Impact:

The redesigned business model not only enhanced the financial health of the company but also positioned it as a leader in the professional services industry. Our client experienced sustained growth, increased client satisfaction, and improved employee morale.

Summary:

If you are seeking a partner to revolutionize your business model, drive profitability, and optimize operations, we are here to guide you. Lock arms with us on a journey of strategic innovation and sustainable growth. Your success story awaits.

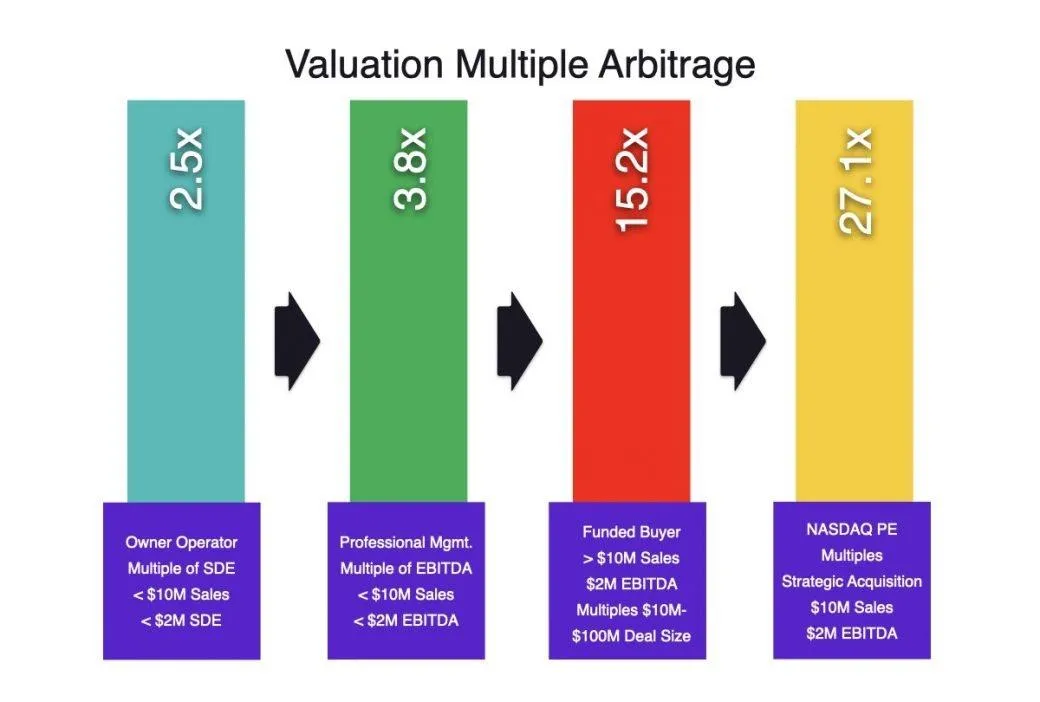

FOCUS #3: INCREASING VALUATION

TRANSFERABLE VALUE

Case Study: Propelling a Digital Publishing Company to New Heights of Success

Increased Sales + Higher Value = Momentum

Challenge:

Our client, a dynamic digital publishing company, sought to elevate their performance by achieving significant growth in both revenue and profits. The primary goal was to not only expand the business but also redefine its position in the market while acquiring additional products to enhance overall value.

Strategic Initiatives:

Revenue Multiplication: Conducted a thorough market analysis to identify untapped opportunities.

Implemented targeted strategies to boost customer acquisition and retention.

Profit Amplification: Introduced innovative monetization models tailored to the digital publishing landscape. Optimized cost structures and operational efficiency to maximize profit margins.

Business Model Repositioning: Evaluated the existing business model and identified areas for enhancement. Successfully repositioned the business to adapt to evolving market trends and consumer preferences.

Product Expansion Through Acquisition: Identified strategic opportunities for acquiring additional products aligned with the company's vision. Executed successful acquisitions, integrating new products seamlessly into the existing portfolio.

Results:

Tripled Revenue: Achieved a threefold increase in annual revenue, reflecting the success of targeted growth strategies.

Profits Soared: Witnessed an impressive twelvefold increase in profits, showcasing the effectiveness of optimized monetization models and operational efficiency.

Business Model Evolution: Successfully repositioned the business model, enabling the company to stay ahead of industry trends and consumer demands.

Value Growth: Acquiring additional products led to a substantial increase in overall business value, positioning the company as a key player in the digital publishing landscape.

Summary:

Whether you're aiming to triple revenue, amplify profits, reposition your business model, or expand through strategic acquisitions, our expertise can guide you towards unparalleled growth. Partner with us, and let's turn your aspirations into a success story that resonates in the dynamic world of digital publishing. Your journey to extraordinary growth begins here.

How we will work together.

ASSESS

Understanding Key Elements

Tax and Ownership Structure: Aligning Financial Foundations

Business Model and TAM: Defining Strategy and Target Addressable Market

Core Beliefs, Values, and Mission: Shaping Organizational Identity

KPIs, Reporting, and Budgeting: Metrics for Measurement and Fiscal Planning

Leadership Score and Review: Evaluating Leadership Effectiveness

Systems, SOPs, and Automation: Streamlining Processes for Efficiency

Customer Success, NPS/CSS: Ensuring Customer Satisfaction and Loyalty

Recruit, Train, Comp/Benefits: Cultivating a Skilled and Motivated Team

Tech Stack and Vendor Analysis: Optimizing Technological Resources

Review and Assess Cost Structure: Analyzing and Enhancing Financial Efficiency

IMPROVE

Enhancing Growth

Test Price Increases

Analyze Price/Margin Pocket Waterfall

Streamline Internal Costs and Introduce Automation

Reduce External Costs and Re-Source Strategically

Optimize Value Ladder and Funnel Structure

Enhance Creative Development and Targeting

Explore Additional Media Channels and Increase Spending

Boost Inbound and Outbound Sales Strategies

Expand Partnerships, Affiliates, and Referral Programs

Leverage Earned, Owned, and Paid Media Channels

Explore Acquisitions for Sustainable Growth

EXIT

Optimize Approaches to Exit

Conduct Internal Commercial Due Diligence (CDD), Legal Due Diligence (LDD), and Financial Due Diligence (FDD)

Review Entity and Personnel Documents

Identify Potential Buyer Pool

Prepare Comprehensive One-Sheet

Solicit Indications of Interest (IOIs) and Secure Non-Disclosure Agreements (NDAs)

Prepare Deck, Confidential Information Memorandum (CIM), and Data Room

Negotiate and Review Letters of Intent (LOIs)

Negotiate Asset Purchase Agreement (APA), Equity Purchase Agreement (EPA), or Share Purchase Agreement (SPA)

Conduct Buyer Commercial Due Diligence (CDD), Legal Due Diligence (LDD), and Financial Due Diligence (FDD)

Facilitate Escrow, Close the Deal, and Ensure Seamless Integration

DO YOU QUALIFY TO WORK WITH US?

Character

Are You Service Focused?

Have A Prosperity Mindset?

Value Impeccable Integrity?

Industry

B2B + B2C Services

e-Learning | SaaS

Franchise | Events | Media

Financial

Sales Range: $500k-$60MM

EBITDA/SDE: $250k - $30MM